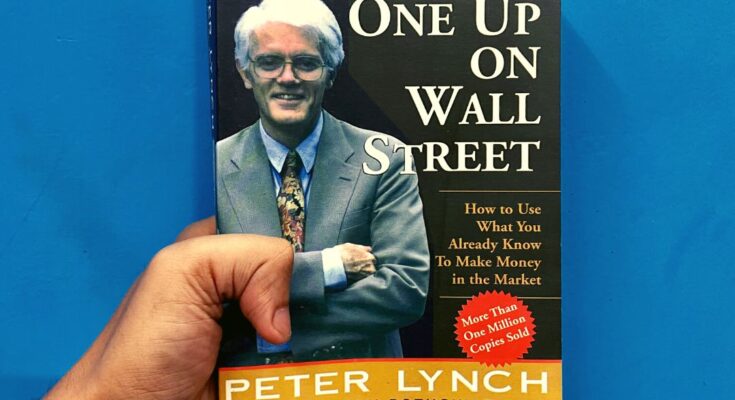

INVESTING LESSONS ― One Up On Wall Street by Peter Lynch

Don’t Invest In the Hottest Stock ― If you want to avoid a single stock, it would be the hottest stock in the hottest industry. Boring stocks give the best results.

Lynch’s strategy to remain underweight on the TRENDING stocks in the hottest sector is nurtured with healthy reasoning in this book One Up The Wal Street. He vehemently recommends abstaining from investing in:

1. The Next Big Thing:―

If you hear that a firm is going to be:

- “the next Microsoft”,

- “the next IBM”,

- “the next Reliance” or

- something like that,

― AVOID IT.

When people tout a stock as the NEXT OF SOMETHING, it often marks the end of prosperity NOT ONLY FOR THE IMITATOR BUT ALSO FOR THE ORIGINAL with which it is being compared.

Otherwise, why would we need, the next IBM, if the already existing IBM is doing well?

According to Lynch, such sought-after stocks rarely hold up in the long term.

2. The Whisper Stock:―

If anyone lowers his/her voice to tell you about a stock, stay away from them. These are long shots, also known as whisper stocks, and the whiz-band stories. They probably reach every neighborhood at the same time.

The company that sells:

- papayas juice derivative as a cure for slipped-disc pain (Smith Labs)

- jungle remedies in general;

- high-tech stuff;

- monoclonal antibodies extracted from cows(Biorespons);

- various miracle additives;

- and energy breakthroughs that violate the laws of physics.

Often the whisper companies are on the brink of solving the latest national problem: the oil shortage, drug addiction, AIDS etc.

The solution is either:

- Very Imaginative, or

- Impressively complicated

As evident from the above discussion, Whisper stocks have a hypnotic effect, and usually, the stories have an emotional appeal. This is where the sizzle is so delectable that the investors forget to notice that there’s no steak.

You don’t need “TIPS” for successful investing decisions. Become a Self-reliant Investor with these 10 Best Books on Stock Market and Investing

3. The Middleman:―

A firm that acts as a middleman and mainly sells to a small number of customers/clients is vulnerable to any sudden change in the market scenario. If even one of their clients cancels the contract, it could be catastrophic to the firm’s finances. Lynch warns against investing in such companies.

In addition, even if the contract is not cancelled, the big client has incredible leverage in extracting price cuts and other concessions, the repercussions of which will be seen in the profit margin of the firm.

A great investment can never come from such an arrangement.

4. The Stock with a Catchy Name:―

The stock market works on demand and supply economics. Catchy names often capture more eyes and hence are mostly selling overvalued.

As long as the company has:

- “Advanced,”

- “Leading,”

- “Micro,” or

- something with an “X”, or

- something catchy in its name,

investors will flock towards it and hence the stock will remain overvalued. So, Lynch suggests searching for prominent firms with boring names. In that search, you are bound to end up finding some great stocks that are cheaply available and at the same time have latent potential to make it big in the long run.

Grab your copy Here ― Amazon IN | Amazon US

Want to become a self-reliant investor?

Check out these 10 Best Books on Stock Market and Investing

The Best Books:

Recommended Reading Lists

1. Best Books To Help You Develop the HABIT of READING

2. Best Books That Teach the Art of Living a HAPPIER LIFE

3. Best Books To Help You Find HOPE During Your Darkest of Times

4. Best Books on Leaning the Art of Songwriting

5. Must-Read Books on Punjab’s History and Culture

That’s all we have for today. Thanks a lot for tuning in to HappinessDhaba. Do let us know your views on these in the comment section. And, don’t forget to add more to the list.

Happy Investing!

Signing off with my favorite words.

Zindagi Zindabad!

Author Profile

Recent Posts

The Punjabi LiteratureJuly 14, 2025Paash on the Death of Dreams ― Sab Ton Khatarnak

The Punjabi LiteratureJuly 14, 2025Paash on the Death of Dreams ― Sab Ton Khatarnak Blog PostsApril 6, 2025Rebuilding Identity After The Self Falls Apart | by Jasmeet

Blog PostsApril 6, 2025Rebuilding Identity After The Self Falls Apart | by Jasmeet Book Summaries & LessonsFebruary 6, 2025BURN IT ALL: Kafka’s Legacy and the Friendship That Saved It

Book Summaries & LessonsFebruary 6, 2025BURN IT ALL: Kafka’s Legacy and the Friendship That Saved It Life Through SongsJanuary 20, 20259 Best Punjabi Heer Ranjha Songs ― The Modern Playlist

Life Through SongsJanuary 20, 20259 Best Punjabi Heer Ranjha Songs ― The Modern Playlist

2 Comments on “Don’t Buy These Stocks ― One Up On Wall Street by Peter Lynch”