The rich focus on their asset columns while everyone else focuses on their income statements.

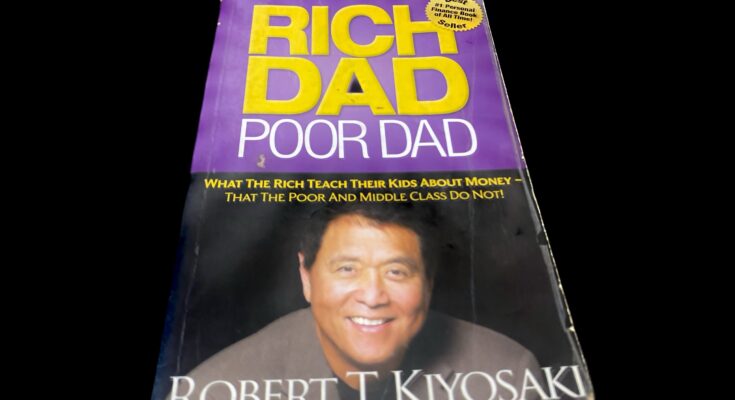

This powerful quote from Robert Kiyosaki’s best-selling book “Rich Dad Poor Dad” resonates with millions of readers worldwide. Rich Dad Poor Dad is more than just a personal finance guide; it’s a life-changing book that challenges traditional beliefs about money and wealth.

In this article, we will explore the key lessons on personal finance from this book and how they can help you achieve financial freedom.

From the importance of financial education to the mindset of the wealthy, we’ll cover the essential principles that can help you build wealth and achieve your financial goals.

Whether you’re a college student, a young professional, or someone looking to improve your financial situation, the lessons from “Rich Dad Poor Dad” can help you take control of your financial future.

If you are into books, do Subscribe to Amazon Audible and listen to unlimited audiobooks and podcasts while doing your daily chores. It’s FREE for the 1st month.

Personal Finance Lessons From Rich Dad Poor Dad:―

1. Cash Flow is The King

“The only difference between a rich person and a poor person is how they manage their money.”

In Rich Dad Poor Dad, Kiyosaki stresses the importance of positive cash flow in personal finance. Cash flow refers to the amount of money coming in and going out of an individual’s accounts.

Net Cash Flow = Total Cash Inflow – Total Cash Outflow.

Individuals can achieve financial stability and long-term wealth by creating positive cash flow and investing that cash in assets that generate passive income.

2. Mind Over Money

“The richest people in the world look for and build networks, everyone else looks for work.”

Kiyosaki emphasizes the importance of mindset in wealth creation in Rich Dad Poor Dad.

A wealthy mindset involves having:―

- A positive attitude towards money and wealth,

- Embracing risk and change,

- Working on building network, and

- Continuously educating oneself about personal finance and investing.

Just as weights are essential for physical fitness, books are essential for mental fitness. If you are someone looking to cultivate the habit of reading, this expertly curated booklist on Best Books To Start Reading Habit is the way to go.

3. Leverage Your Way to Wealth

“The rich get richer, the poor get poorer and the middle class struggles financially because of their approach to money and assets.”

Kiyosaki explains the power of leverage as a key strategy for building wealth in Rich Dad Poor Dad.

Leverage refers to using other people’s money to acquire assets, such as real estate, stocks, or bonds, with the aim of generating a higher return on investment.

The impact of leverage on return on investment can be calculated using the following equation:

ROI = (Gain from Investment – Cost of Investment) / Cost of Investment.

4. The Entrepreneurial Mindset

Kiyosaki emphasizes the importance of entrepreneurship in achieving financial freedom in Rich Dad Poor Dad

He says,

“An entrepreneur is someone who jumps off a cliff and builds a plane on the way down.”

Individuals can create passive income and control their financial future by building multiple streams of income and taking calculated risks.

5. Invest in Your Financial Education

Kiyosaki emphasizes the importance of continuous financial education in Rich Dad Poor Dad.

He says,

The best investment you can make is in your own abilities. Talent, skills, and knowledge will give you a high return on investment.

Financial literacy and education can help individuals make informed decisions about their money, investments, and personal finances, which can lead to financial stability and long-term wealth.

If you are into Stock Market and Investing, you would love this booklist on Best Books To Excel in STOCK MARKET & INVESTING

6. The Power of Real Estate Investing

Kiyosaki highlights real estate investing as a key strategy for building wealth in Rich Dad Poor Dad.

He says,

“Real estate is the ultimate long-term investment.”

Real estate investing offers the potential for high returns and passive income, and it provides a hedge against inflation. When investing in real estate, individuals can use a variety of strategies, including buying and holding, flipping, or renting, to generate income and build wealth over time.

If you are into books, do Subscribe to Amazon Audible and listen to unlimited audiobooks and podcasts while doing your daily chores. It’s FREE for the 1st month.

7. The Art of Financial Planning

In Rich Dad Poor Dad, Kiyosaki stresses the importance of financial planning in personal finance.

He says,

“A budget is telling your money where to go instead of wondering where it went.”

A solid financial plan involves

- Setting financial goals,

- Creating a budget,

- Saving for emergencies, and

- Investing for the future.

Individuals can achieve financial stability and long-term wealth by taking control of their finances and creating a plan.

8. The Magic of Passive Income

Kiyosaki emphasizes the importance of passive income in achieving financial freedom in Rich Dad Poor Dad.

He says,

When your assets generate enough income to cover your expenses, you are wealthy, even if you are not yet rich.

Passive income refers to income that is generated without requiring active involvement, such as rental income, dividends, or interest. Individuals can achieve financial stability and long-term wealth by investing in assets that generate passive income.

9. The Value of Financial Freedom

Kiyosaki defines financial freedom as a state of having enough passive income to cover one’s living expenses.

He says,

“Financial freedom is having enough passive income to cover your living expenses.”

In Rich Dad Poor Dad, Kiyosaki explains that financial freedom is the ultimate goal of wealth creation, as it allows individuals to live life on their own terms without being forced into working a job they hate

. He compares financial freedom to be a bird that is free to fly, soaring above the stress and constraints of a traditional job. Just as a bird is free to explore new horizons and opportunities, financial freedom provides individuals with the same sense of freedom and choice in their lives.

Grab Your Copy Here ― Amazon In | Amazon US

If you are into books, do Subscribe to Amazon Audible and listen to unlimited books and podcasts while doing your daily chores. It’s FREE for the 1st month.

The Best Books: Recommended Reading Lists

1. Best Books That Teach the Art of Living a HAPPIER LIFE

2. Best Books on STOCK MARKET & INVESTING

3. Best Books To Help You Find HOPE During Your Darkest of Times

4. Best Books on Learning & Mastering SONGWRITING

5. Must-Read Books on Punjab’s History and Culture

6. Best Books That Talk about SOLOGAMY

7. Books Chris McCandless Took On His Journey ― INTO THE WILD

8. 7 Alan Watts Books That Talk About Human Existence

9. From PhD To Industry: 4 Best Books To Aid Your Transition

10. Inspiring Ambitions: Autobiographies of Cricketers Who Made It Big

11. Best Books Debating the Existence of Free Will

12. Books To Understand Blockchain Technology

That’s all we have for today.

Thanks a lot for tuning in to HappinessDhaba. Do let me know your views on this in the comment section.

Signing off with my favourite words

Zindagi Zindabad!

Author Profile

Recent Posts

The Punjabi LiteratureJuly 14, 2025Paash on the Death of Dreams ― Sab Ton Khatarnak

The Punjabi LiteratureJuly 14, 2025Paash on the Death of Dreams ― Sab Ton Khatarnak Blog PostsApril 6, 2025Rebuilding Identity After The Self Falls Apart | by Jasmeet

Blog PostsApril 6, 2025Rebuilding Identity After The Self Falls Apart | by Jasmeet Book Summaries & LessonsFebruary 6, 2025BURN IT ALL: Kafka’s Legacy and the Friendship That Saved It

Book Summaries & LessonsFebruary 6, 2025BURN IT ALL: Kafka’s Legacy and the Friendship That Saved It Life Through SongsJanuary 20, 20259 Best Punjabi Heer Ranjha Songs ― The Modern Playlist

Life Through SongsJanuary 20, 20259 Best Punjabi Heer Ranjha Songs ― The Modern Playlist